Condo Insurance in and around Broken Arrow

Condo unitowners of Broken Arrow, State Farm has you covered.

State Farm can help you with condo insurance

- Tulsa County

- Wagoner County

- Creek County

- Muskogee County

- Rogers County

- Osage County

Your Search For Condo Insurance Ends With State Farm

Your condo is your home. When you want to take it easy, wind down and kick back, that's where you want to be with family and friends.

Condo unitowners of Broken Arrow, State Farm has you covered.

State Farm can help you with condo insurance

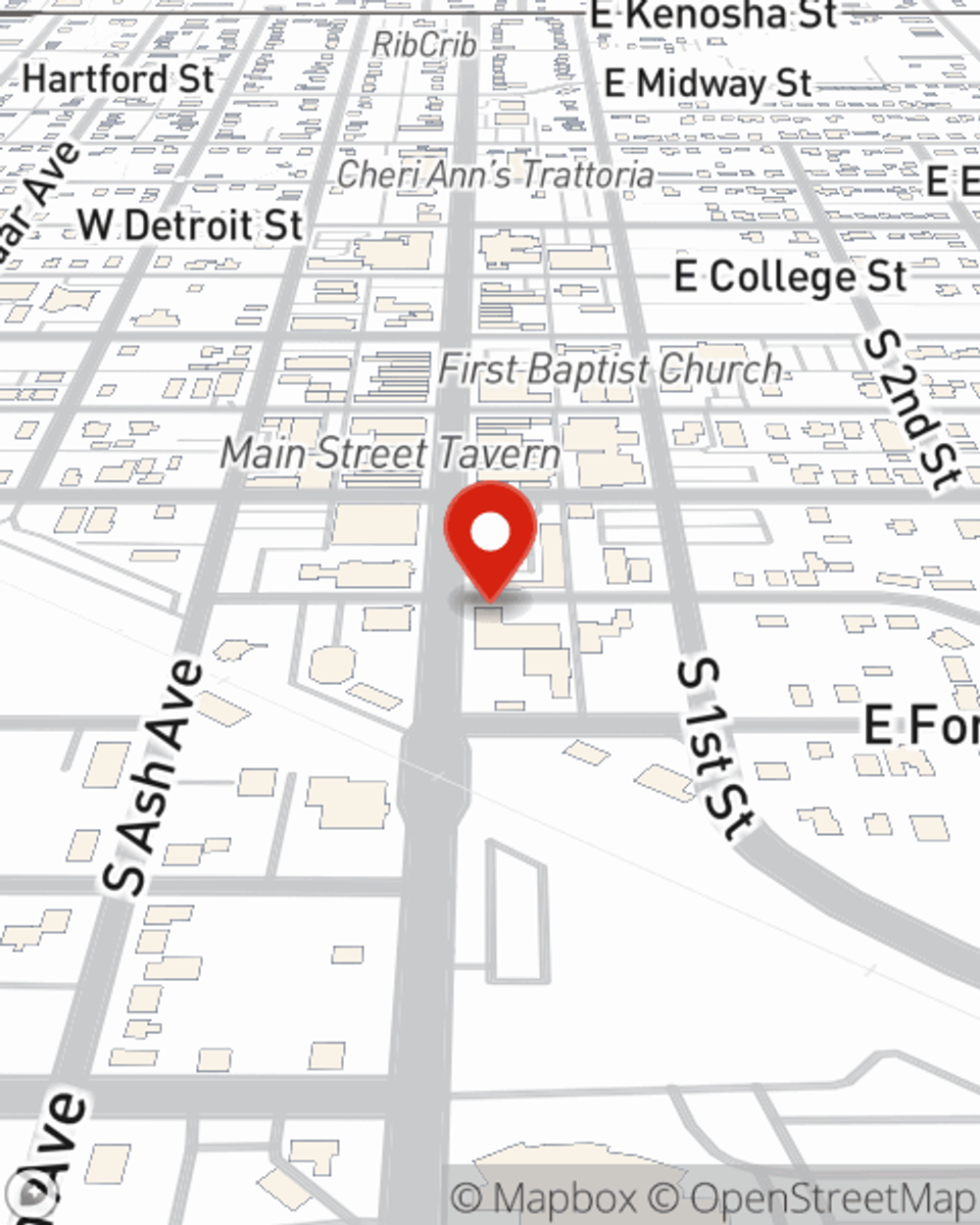

Agent Todd Brown, At Your Service

Your condo is a special place. You need condo unitowners coverage to keep it safe! You’ll get that with Condominium Unitowners Insurance from State Farm, a trusted provider of condo unitowners insurance. Todd Brown is your dependable State Farm Agent who can present coverage options to see which one fits your particular needs. Todd Brown can walk you through the whole coverage process, step by step. You can have a hassle-free experience to get coverage options for everything that's meaningful to you. We’re talking about more than just protection for your swing sets, furniture and clothing. You'll want to protect your family keepsakes—like souvenirs and mementos. And don't forget about all you've collected for your hobbies and interests—like videogame systems and musical instruments. Agent Todd Brown can also let you know about State Farm’s great savings and coverage options. There are savings if you have home security devices or have a claim-free history, and there are plenty of different coverage options, such as personal articles policy and even additional business property.

Ready to learn more? Agent Todd Brown is also ready to help you see what customizable condo insurance options work well for you. Visit today!

Have More Questions About Condo Unitowners Insurance?

Call Todd at (918) 258-3531 or visit our FAQ page.

Simple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Simple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.